Microeconomics Key Concepts: Definitions, Costs, and Market Structures

Microeconomics: Key Concepts and Principles

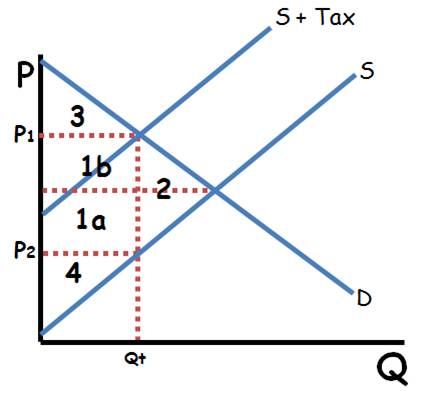

Effective altruism: Doing the most good you can possibly do for society with limited resources (time and money). Opportunity cost: The cost of choosing one alternative over another, calculated as the value of the opportunity that is given up as a result of the choice. Absolute advantage: Fewer resources. Comparative advantage: Lower opportunity cost. Normal good: Increased demand when income increases. Inferior good: Decreased demand when income decreases. Elasticities: E > 1: elastic, E=1: unit elastic, E < 1: inelastic. Determinants of PED: Availability and price of substitutes, short/long run, brand, type of good, necessity/luxury, percentage of income. Determinants of PES: Ease to increase production, market share for inputs, local/global supply, short/long run. Market equilibrium: The point at which the quantity of a good or service demanded is equal to the quantity supplied. Market failure: Allocative inefficiency and the overallocation or underallocation of resources to producing a good or service, creates externalities and deadweight loss. Externality: Cost or benefit of an economic activity experienced by an unrelated third party. Deadweight loss: Loss of social welfare and economic efficiency that occurs when the market equilibrium for a good or service is not Pareto optimal. Pareto optimality: When it is impossible to make any one person better off without making someone else worse off. Coase Theorem: As long as transaction costs are low (i.e., it is relatively easy and inexpensive for the two farmers to negotiate and reach an agreement), the allocation of resources will be efficient regardless of who has the legal right to produce the smoke. In many cases, the most effective way to address externalities is to allow the parties involved to negotiate and reach an agreement, rather than relying on government intervention or regulation. Pigouvian tax or subsidy: Tax/subsidy imposed on good with externality. Internalize externalities by: Pigouvian taxes, subsidies, cap-and-trade system, command-and-control regulation, Coase theorem. Marginal cost: The cost of producing one more unit of a good or service. Average total cost: The total cost per unit of output, calculated as the total cost divided by the quantity of output. Average variable cost: The variable cost per unit of output, calculated as the variable cost divided by the quantity of output. Perfect competition: A market structure characterized by a large number of firms producing a homogeneous product, free entry and exit, and well-informed buyers and sellers. Short run: A time frame in which at least one input is fixed and cannot be varied. Long run: A time frame in which all inputs are variable and can be varied. Fixed costs: Costs that do not vary with the quantity of output produced. Variable costs: Costs that vary with the quantity of output produced. Sunk costs: Costs that have already been incurred and cannot be recovered. Law of diminishing marginal returns: As the quantity of a variable input increases, holding all other inputs constant, the marginal product of the input will eventually decline. To price discriminate, firms must: Identify different market segments, prevent arbitrage, deal with price discrimination accusations, and balance the benefits and costs of price discrimination. Barriers to entry: Obstacles that prevent or discourage new firms from entering a market, such as high start-up costs, patents, licenses, or exclusive contracts. Natural monopolies: Industries in which a single firm can provide goods or services to an entire market at a lower cost than any potential competitor. Collusion: An agreement between firms to coordinate their behavior in order to achieve a common goal, often at the expense of consumers. Price fixing: An illegal form of collusion in which firms agree to set prices at a certain level rather than compete for market share. Price leadership: A form of collusion in which one firm takes the lead in setting prices and the other firms follow. Network effects: The phenomenon in which the value of a product or service increases as more people use it. Tragedy of the commons: The tendency of any resource that is unowned and hence nonexcludable to be overused and undermaintained. Nonrival goods (free goods): One person’s use of the good does not reduce the ability of another person to use the same good. Nonexcludable goods: People who don’t pay cannot be easily prevented from using the good. Public good: Nonexcludable & nonrival. Free riders enjoy benefit of public goods without paying costs. Adverse selection: An offer conveys negative information about the product being offered. Moral hazard: An agent tries to exploit an information advantage in a dishonest or undesirable way. One party in a transaction is less risky because it bears fewer consequences of its actions. Agency costs: Costs that a firm incurs as a result of the separation of ownership and control, when the managers of a firm may not always act in the best interests of the owners (the shareholders). The costs that arise when one person (the “agent”) is acting on behalf of another person (the “principal”). Concentrated benefits: Benefits that are concentrated among a small group of people. Diffuse benefits: Benefits that are spread out among a large group of people.

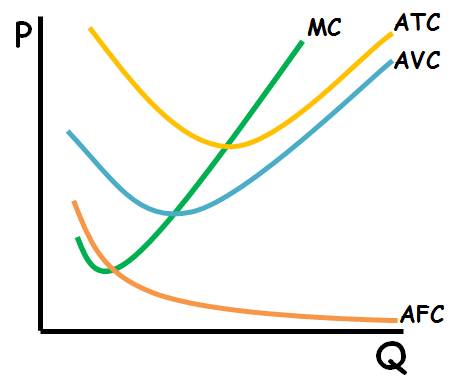

Cost Curves Explained

The total cost curve is the sum of the fixed cost curve and the variable cost curve.

The average fixed cost curve is found by dividing the fixed costs by the quantity of output.

The average variable cost curve is found by dividing the variable costs by the quantity of output.

The average total cost curve is found by dividing the total costs by the quantity of output.

The marginal cost curve is the change in total cost that results from a one-unit increase in output.

The marginal cost curve intersects the average total cost curve at its minimum point.

The marginal cost curve intersects the average variable cost curve at its minimum point.

The marginal cost curve intersects the average fixed cost curve at its minimum point.

The marginal cost curve is typically U-shaped, with marginal cost decreasing at first and then increasing.

The marginal cost curve is typically U-shaped because as a firm increases production, it initially experiences decreasing marginal costs due to increasing economies of scale, but eventually reaches a point where diminishing returns set in and marginal costs start to rise. ~ The marginal cost curve intersects the average total cost curve at the minimum point of the average total cost curve because when average total cost is at a minimum, any increase in output will result in a smaller increase in total cost than it did previously. ~ The marginal cost curve intersects the average variable cost curve at the minimum point of the average variable cost curve because when average variable cost is at a minimum, any increase in output will result in a smaller increase in variable cost than it did previously. ~ The difference between average total cost and average variable cost is equal to average fixed cost because average total cost is equal to average variable cost plus average fixed cost.

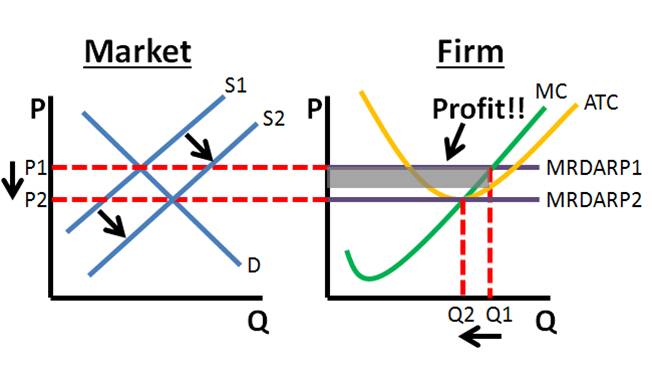

A firm in perfect competition will produce at a profit if price is greater than average total cost, at zero profit if price is equal to average total cost, and at a loss if price is less than average total cost. ~ A firm in perfect competition will shut down in the short run if price is less than average variable cost because it is not profitable to even cover the variable costs of production.

Market Structures: Monopolistic Competition and Monopoly

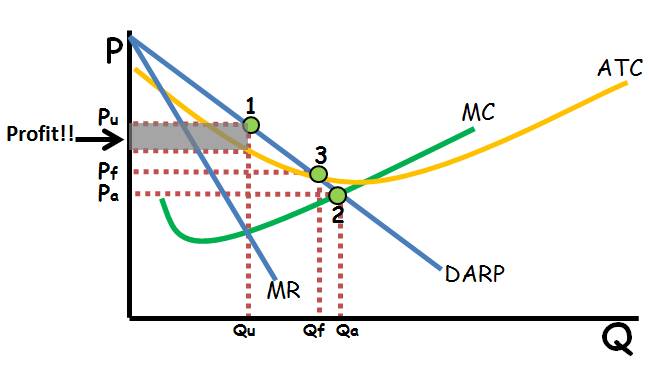

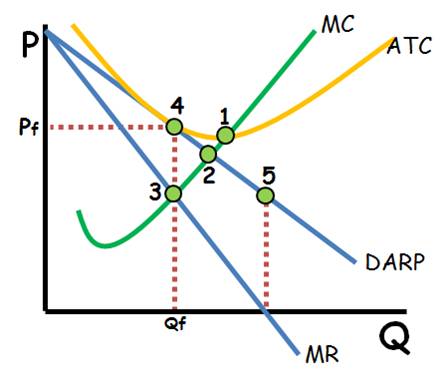

Monopolistic Competition: 1. Productive efficient point (Minimum of ATC) ~ 2. Allocative efficient point (MC=MB) quantity below ~ 3. Actual output (MR=MC) and price (DARP above MR=MC at point 4) ~ 4. Unit elastic portion of the demand curve (where MR equals zero at that quantity). Demand is inelastic below and elastic above this point. • Deadweight loss is in the triangle between points 2,3, & 4.

Monopoly: 1. The monopoly price and quantity Pu and Qu when if it is unregulated. 2. The allocatively efficient price and quantity. A government price ceiling here would cause the firm to incur a loss. 3. Fair return price. A price ceiling here would still be inefficient, but there would be less deadweight loss and the firm would break even so it would continue to operate in the long run. 4. If this is a monopolistically competitive market, firms would enter the market shifting MR and DARP left as this firms market share decreases.